- Key Takeaways

- Key Considerations

- Setting Your Pay

- Sole Proprietor Payment

- Partnership Payments

- Corporation Compensation

- Payroll Schedule

- Managing Taxes

- Maintaining Cash Flow

- Owner's Equity

- Final Remarks

- Frequently Asked Questions

Did you know that over 25% of small business owners pay themselves less than $50,000 annually, considering personal expenses and employment taxes? If you are looking to increase your personal income while managing your business finances effectively, understanding how to pay yourself as a business owner is crucial, especially to ensure you have enough money for your paycheck and employment taxes. By implementing smart strategies and separating personal and business finances, you can ensure a fair salary for yourself without jeopardizing the financial health of your company.

Key Takeaways

- Consider Your Business Structure: Choose a payment method that aligns with your business structure, whether you're a sole proprietor, in a partnership, or running a corporation.

- Determine Your Pay: Set a reasonable salary for yourself based on your business's financial health and industry standards.

- Sole Proprietors: Pay yourself from the profits of the business, considering tax implications and personal financial needs.

- Partnerships: Distribute profits among partners according to the agreed-upon partnership agreement.

- Corporations: Decide on a combination of salary and dividends, keeping in mind tax obligations and shareholder expectations.

- Regular Payroll: Establish a consistent payroll schedule to ensure timely and organized payments to yourself and any employees.

- Tax Management: Stay on top of tax responsibilities by setting aside funds for taxes regularly and seeking professional advice when needed.

- Cash Flow Planning: Monitor your business's cash flow to ensure you can afford your salary while meeting other financial obligations.

- Owner's Equity: Understand how your pay impacts the equity of the business and make informed decisions to maintain a healthy balance between personal compensation and business growth.

Key Considerations

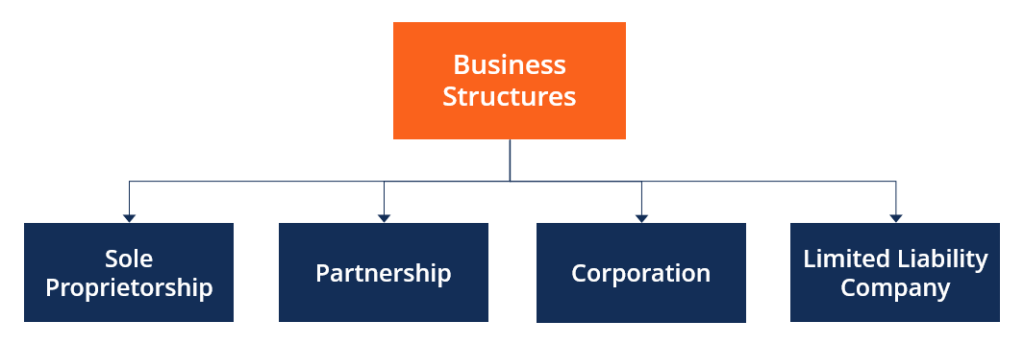

Business Structure

Sole Proprietor

- Determine your draw frequency based on cash flow to meet needs efficiently.

- Recognize personal liability for business debts as a sole proprietor.

- Manage finances effectively by setting up a separate business account.

Partnership

- Openly discuss payment structure and profit-sharing with partners.

- Establish clear agreements on individual draws and contributions.

- Ensure fair compensation by tracking each partner's input accurately.

Corporation

- Differentiate between C corporations and S corporations for tax purposes.

- Consider the impact of double taxation within C corporations.

- Benefit from limited liability protection in a corporation setup.

Financial Review

- Analyze your business's financial health thoroughly for informed decisions.

- Identify crucial financial metrics to gauge sustainability in paying yourself.

- Consult professionals if interpreting complex financial data seems challenging.

Tax Implications

- Understand self-employment taxes applicable to top business owners.

- Compare the tax advantages of salary versus draw payments carefully.

- Stay updated on evolving tax laws that can influence payment strategies.

Cash Flow

- Regularly monitor your business's cash flow to ensure prompt payments to yourself.

- Improve cash flow through effective strategies when necessary.

- Maintain financial clarity by segregating personal and business expenses diligently.

Setting Your Pay

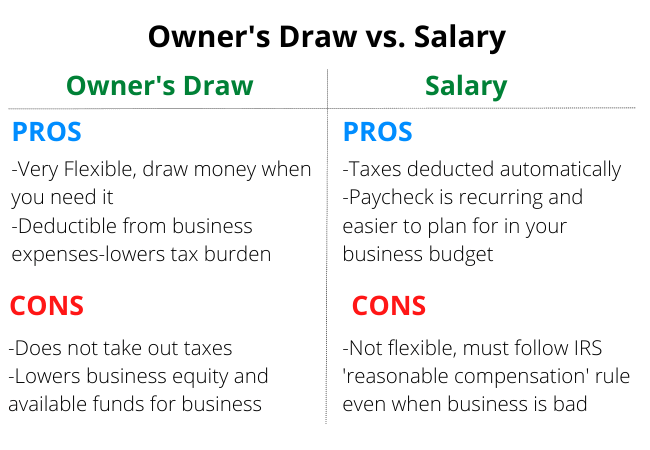

Salary vs. Draw

Decide between a salary and a draw by analyzing how each option fits your business model. Taking a salary offers stability but may have higher tax implications. On the other hand, a draw provides flexibility but can be uncertain during lean periods.

Consider the tax implications of both methods before finalizing your decision. A salary is subject to payroll taxes, while a draw is not taxed until you file your personal income tax return. Evaluate which option aligns best with your financial objectives and long-term plans.

Choosing the right payment method is crucial for your financial future. Select the option that complements your business goals and helps you achieve sustainable growth in the long run.

Finding the Magic Number

Forecast your future earnings and expenses to determine the ideal payment amount for yourself. By projecting revenue and costs, you can calculate a reasonable figure that ensures both personal compensation and business sustainability.

When calculating your pay, consider various factors like tax obligations, upcoming business expansions, and unexpected expenditures. Adjust your payment amount periodically to adapt to changing circumstances and maintain financial health.

Regularly reviewing and revising your payment strategy ensures that you stay on track with your financial objectives and remain resilient against unforeseen challenges.

Payment Methods

When you're running your own business, it's important to figure out how you're going to pay yourself. One way to do this is by exploring different payment options that suit your needs. Direct deposits are a quick and easy way to get your money, as the funds go straight into your bank account without you having to do anything. On the other hand, checks are a more traditional method where you physically receive a paper check that you can deposit at the bank. To make things even easier for yourself, consider setting up automatic payments. This means that your salary will be sent to you automatically on a regular basis, so you don't have to worry about remembering to pay yourself each time. By using accounting software, you can simplify the process even further by keeping track of all your transactions and making sure everything is recorded properly. By choosing the right payment method and setting up automated processes, you can make sure that you're paying yourself in a way that is convenient and efficient for your business.

Sole Proprietor Payment

Owner's Draw

As a business owner, an owner's draw allows you to pay yourself directly from the business profits. This draw impacts your equity, affecting your company's financial health. Keeping detailed records of each draw is crucial for accurate financial tracking.

Consulting with a financial advisor can help you develop an effective strategy for taking owner's draws. They can provide insights on the optimal timing and amount for your draws, ensuring they align with your business goals and cash flow needs.

Tax Insights

Understanding tax implications is essential when paying yourself as a sole proprietor. Stay updated on tax deductions and credits available to business owners, maximizing your tax savings. By utilizing tax planning strategies, you can minimize your tax liability and optimize your personal income.

When deciding on your payment structure, consider the potential tax consequences associated with each option. Different payment methods may have varying impacts on your tax obligations, so it's crucial to choose wisely based on your financial situation and long-term goals.

Partnership Payments

Equity Distribution

Partners in a business should allocate profits fairly based on their individual contributions to the company. This ensures that each partner receives a share that reflects their input into the business. Regularly review and adjust equity distribution to account for changes in partners' roles or investments. By doing so, you maintain fairness and motivation within the partnership. Documenting all decisions related to equity distribution is crucial for transparency and accountability among partners.

Draw and Taxes

When taking an owner's draw, it's essential to understand the tax implications associated with this type of payment. Different forms of business ownership have varying tax obligations, so make sure you are aware of these before withdrawing funds from the company. To avoid any surprises come tax season, set aside a portion of your draw for estimated quarterly taxes. Consulting with a tax professional can provide valuable insights into how to manage your draws efficiently while complying with tax regulations.

Corporation Compensation

Salary Approach

Determining a reasonable salary is crucial for business owners. Look at industry standards and your financial performance to set an appropriate amount. Withholding payroll taxes accurately prevents costly penalties. Adjust your salary as needed based on business growth and profitability.

When setting your salary, consider the financial health of your business. Ensure that it aligns with what other professionals in your field earn. By staying informed about industry standards, you can make informed decisions about your compensation.

Shareholder Distributions

Understanding the difference between shareholder distributions and employee salaries is essential. While salaries are regular payments for services rendered, distributions come from profits. Adhering to legal requirements when distributing profits to shareholders is vital to avoid legal issues.

Shareholders play a crucial role in corporations. Keeping them informed about distribution decisions fosters transparency and trust. Open communication helps shareholders understand how their investments translate into returns.

Incorporating the insights from the previous section on "Partnership Payments," business owners must navigate the complexities of compensating themselves effectively within a corporation structure. By understanding the nuances of salary determination and shareholder distributions, entrepreneurs can ensure fair and compliant compensation practices.

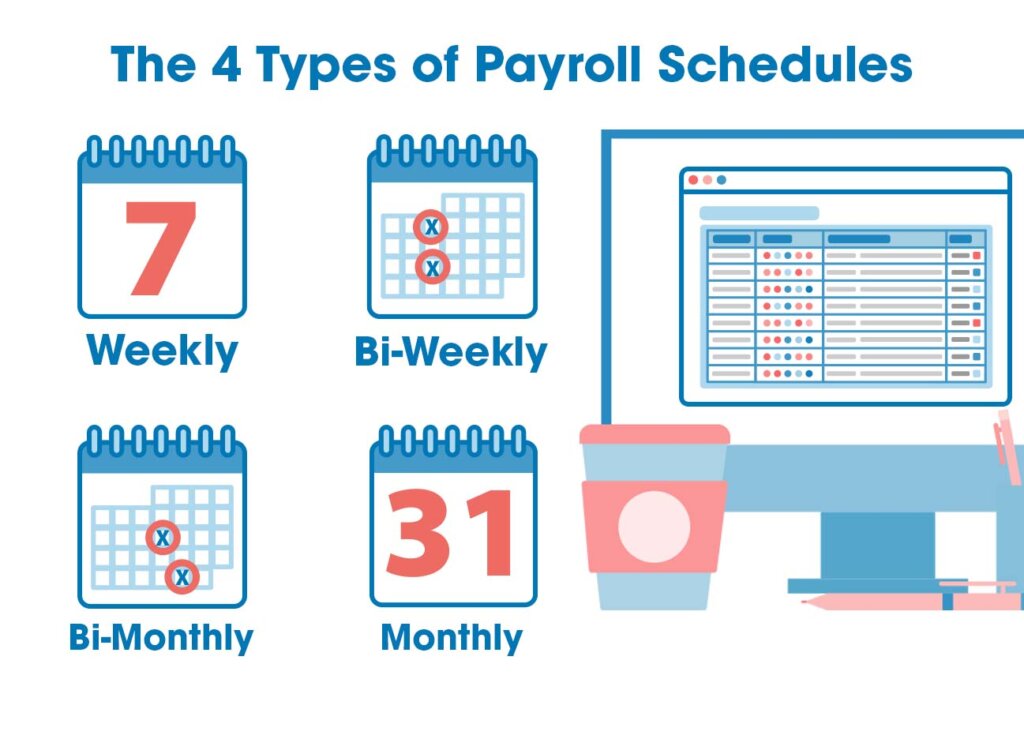

Payroll Schedule

Establishing Frequency

Choosing a payment frequency is crucial for business owners. It should align with the company's cash flow to ensure financial stability. Consider the administrative burden associated with more frequent payments, balancing efficiency and cost-effectiveness.

Clearly communicate the payment schedule with all stakeholders involved. Transparency fosters trust and ensures everyone is aware of when to expect their paycheck. This clarity helps streamline operations and avoids misunderstandings.

Consistency Importance

Emphasizing the importance of consistent payments is key for business owners. Maintaining a regular payment schedule to yourself helps stabilize your personal finances and instills discipline in managing cash flow. Prioritize consistency over fluctuating payment amounts to avoid financial instability.

Adjusting payment amounts as needed is acceptable, but always prioritize maintaining a consistent payment schedule. This practice not only benefits your personal finances but also sets a positive example within the company. Consistency builds trust and reliability among employees and stakeholders.

Managing Taxes

Income Tax Overview

Understanding income tax brackets is crucial for accurate tax reporting and planning financial strategies effectively. Different rates apply depending on your income level, impacting your overall tax liability. Distinguishing between ordinary income and capital gains is essential; the former includes wages, salaries, and bonuses, while the latter involves profits from investments like stocks or real estate. Maintaining detailed records of all income sources ensures compliance with tax regulations and minimizes errors during filing.

Deductions and Credits

Identifying eligible business expenses is vital to reduce taxable income, thereby lowering your overall tax burden. By leveraging deductions such as office supplies, equipment costs, or travel expenses, you can optimize your tax situation. Small business owners can benefit from various tax credits, including those for research activities or hiring certain employees. Seeking guidance from a qualified tax professional can help you navigate complex tax laws efficiently and maximize savings through strategic planning.

Maintaining Cash Flow

Healthy Practices

Implement healthy financial practices to ensure long-term business sustainability. Save for emergencies and future investments. Seek financial education for informed decisions.

Monitoring Expenses

Track personal and business expenses for financial clarity. Regularly review expenses to find cost-saving opportunities. Use budgeting tools to adjust payment amounts.

Owner's Equity

Understanding Equity

Equity in a business represents the owner's stake in the company, reflecting the amount of assets that belong to the owner. By tracking equity, you can gauge how much of the business you truly own. Over time, changes in equity provide insights into your business's financial health and performance.

Keep a close eye on fluctuations in equity as they reveal how well your business is doing. If equity is increasing, it indicates that your business is growing and generating profits. On the other hand, a decrease might signal financial challenges that need addressing promptly.

To boost your equity value in the long term, consider reinvesting profits back into the business. This strategy can lead to increased assets and higher overall equity over time, strengthening your financial position as a business owner.

Equity Withdrawals

When planning equity withdrawals, it's crucial to do so strategically to prevent adverse effects on your company's financial stability. Drawing out too much equity could leave your business short on funds for operations or growth initiatives. Therefore, it's essential to plan withdrawals carefully.

Consulting with a financial advisor can help you determine the optimal timing for taking out equity. An advisor can analyze your business's financial status and advise you on how much equity you can safely withdraw without jeopardizing the company's operations.

While withdrawing equity can provide you with personal income, consider reinvesting a portion of these funds back into the business. By allocating some of the withdrawn equity towards growth opportunities such as expanding product lines or entering new markets, you can fuel further development and increase profitability.

Leveraging MarketersMEDIA for Business Owners

As a business owner, it's crucial to ensure that you are effectively communicating with your target audience and potential customers. One powerful tool that can help you achieve this is MarketersMEDIA.

MarketersMEDIA is a press release distribution service that allows business owners to share their news, updates, and announcements with a wide audience. By leveraging MarketersMEDIA, you can increase your brand visibility, reach new customers, and establish yourself as an authority in your industry.

Using MarketersMEDIA is simple and straightforward. You can easily create and distribute press releases that highlight your business achievements, product launches, or any other important updates. This can help you attract media attention, generate buzz around your brand, and drive traffic to your website.

MarketersMEDIA is a valuable resource for business owners looking to pay themselves by increasing their brand visibility and reaching new customers. By utilizing this platform effectively, you can take your business to the next level and achieve the success you deserve.

Statistics on Paying Yourself as a Business Owner:

As per the Small Business Administration's survey, it was revealed that a mere 40% of small business owners choose to give themselves a fixed salary. The remaining majority opt to rely on profits and dividends as their source of personal income. This approach often results in unpredictable fluctuations in their paychecks, making it challenging to budget and plan for personal expenses effectively. Additionally, a study conducted by Fundera highlighted that almost one-third (30%) of small business owners face difficulties in determining the appropriate amount to pay themselves. This dilemma can lead to increased financial pressure and hinder efforts to strike a balance between work and personal life. To address this issue, it is essential for business owners to establish a well-defined and sustainable payment framework for themselves. By setting clear guidelines for personal compensation, entrepreneurs can better manage their finances, alleviate stress related to income uncertainty, and foster a healthier work-life equilibrium. Implementing a structured payment system not only promotes financial stability but also enhances overall business performance and long-term success.

Final Remarks

In managing your business finances, paying yourself is crucial. Consider your business structure, tax obligations, and cash flow when determining your compensation. Whether you are a sole proprietor, partner in a business, or running a corporation, understanding the best payment method for you is essential.

Frequently Asked Questions

How important is it to consider different payment methods as a business owner?

It's crucial to choose the right payment method to ensure financial stability, legal compliance, and personal financial planning aligned with your business structure.

What factors should be considered when setting your pay as a business owner?

Considerations include business profitability, industry standards, personal financial needs, tax implications, legal requirements, and the impact on cash flow and overall business sustainability.

How can a sole proprietor determine their payment structure?

e proprietors typically pay themselves through owner's draws or distributions based on profits. It's essential to separate personal and business finances and consult with an accountant for tax implications.

What are common ways for partners in a business partnership to pay themselves?

Partners often receive payments through profit-sharing based on ownership percentages or guaranteed payments. Clear partnership agreements outlining compensation terms are essential for smooth operations.

How do owners of corporations compensate themselves?

Corporation owners can pay themselves through salaries, dividends, or bonuses. The choice depends on various factors like tax efficiency, cash flow needs, and compliance with legal requirements and corporate governance.

Free Press Release Template

Tell us where to send your PDF: