—

Montana 1031 exchange company, 1031 Property Exchange, LLC, offers investment real estate tax planning advice and strategies for investment property owners.

The company is a full service Qualified Intermediary with offices in Bozeman, Montana that has been performing 1031 exchanges for several decades. The company has performed 1031 exchanges in all 50 States.

“We look at the 1031 exchange through financial eyes because this law is all about tax-deferred wealth accumulation through the process of tax sheltering”, says Rusty Squire, Qualified Intermediary. He adds, “Compound interest is the eighth wonder of the world according to Albert Einstein and we know he is right”.

“The 1031 exchange laws are not all that complex and they were first established in 1979 before the United States Supreme Court in the Starker case”, says Squire. He adds, “There are essentially a small set of fundamental rules, guidelines and safe harbors that each exchanger must be aware of and comply with”.

“1031 Property Exchange is a full service company in that we prepare all exchange documents, offer advice and establish qualified escrow accounts to meet the requirements of IRC 1031”, says Squire. He adds, “As a Montana 1031 exchange company we are not limited geographically and we have performed exchanges in all 50 States over the past several decades”.

“The best thing most Realtors and their clients can do is consult with us prior to selling investment property”, says Squire. He adds, “Sellers cannot have constructive receipt of their property proceeds and the failure to set up a 1031 exchange prior to closing will get an exchange disqualified by the IRS”.

MAKING IT TAX-FREE

“A lot of investors don’t realize that all the wealth accumulated doing 1031 exchanges throughout one’s lifetime can actually become a tax-free transfer of wealth”, says Squire. He adds, “As long as your gross estate is not in excess of the Federal Estate tax limits, which were a little over $5 million in 2017, then your heirs get a step up in cost basis upon your death and the entire transfer is tax-free”.

“For real estate investors this makes 1031 an enormous tax and estate planning tool over one’s lifetime”, says Squire. He adds, “Through using advanced tax strategies like bifuracation, investing in IRA’s and other strategies you can really accumulate some serious wealth and diversify”.

WHAT IS A QUALIFIED INTERMEIDARY

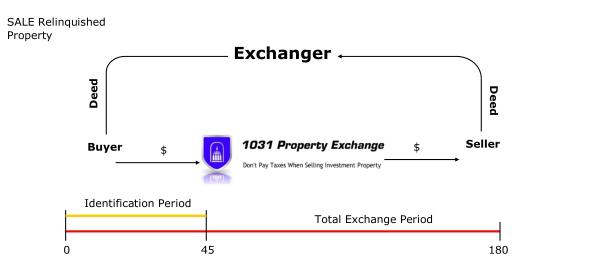

“To complete a legal 1031 exchange you must make use of a qualified intermediary, so what is that?”, asks Squire. He adds, “It is someone who is independent and does not act as your Realtor, financial advisor, accountant or in any other form of professional advisory”.

“You must also make use of a qualified escrow account if you are not closing both your relinquished and replacement property transactions on the same day”, says Squire. He adds, “The IRS does not allow you to have constructive receipt or beneficial use of your proceeds during your exchange”.

OTHER BASIC RULES

“You have a total of 180 days to complete your exchange from the date you close on your initial relinquished property”, says Squire. He adds, “You then have 45 days to identify replacement properties and there are a host of additional rules we educate our clients on, especially those related to personal use”.

If you would like further information on 1031 exchange tax planning and wealth building strategies then simply contact Bozeman 1031 exchange Qualified Intermediary Rusty Squire at 1031 Property Exchange at 406-425-2742.

Release ID: 391110