—

Independent life insurance agency, LifeNet Insurance Solutions, published a new how-to guide dedicated to helping baby boomers and their families master the steps to understanding the various life insurance products for seniors.

Interested parties are invited to review the how-to guide in full on the company website: The Final Expense Life Insurance Handbook

This latest how-to guide from LifeNet Insurance Solutions contains step-by-step instructions that are designed to be used by baby boomers and their families to purchasing the least expensive policy type. This easy to follow guide provides all of the information necessary to understand the topic.

The full how-to guide covers:

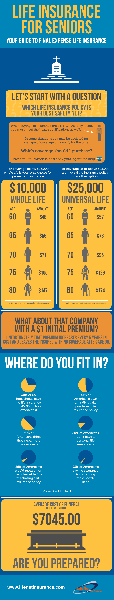

Types of coverage based upon amount and applicant’s health – Final Expense Life Insurance

Why some products geared toward seniors may have premiums triple the cost for the same of death benefit, but are not made available to seniors by agents that specialize in senior products only.

Some widely advertised products for seniors are designed to end at age 80 and/or increase in cost every 5 years.

When asked about the reasons behind creating this guide, owner of LifeNet Insurance Solutions Lenny Robbins said, “Most final expense buyers are unfamiliar with what products are available to them and therefore end up with coverage that may not meet their desired needs.” I have spoken to many seniors and other family members that failed to understand what type of policy they own and how it is designed. “For this reason”, Robbins said, “we are seeing many children of seniors unhappy with their parents’ current insurance because it becomes much too expensive in later years, or it does not continue for the insured’s lifetime. In many cases we are able to offer the client a policy with better guarantees at or below their current premiums.”

Professionals who need help with understanding the various life insurance products for seniors are invited to review the how-to guide online:

Release ID: 66127